Let’s play a game that you may have seen on Ellen: Never Have I Ever. Raise your hand (and hide behind it if you have to) if any of these apply to you!

- Ever opened a bank account without understanding its features?

- Ever stressed about your family budget?

- Ever worried about buying something on credit?

- Ever wondered about how to pay a bill?

- Ever ignored your investment statement because you couldn’t understand it?

- Ever questioned your retirement savings plans?

- Ever freaked out about your debt?

Raise your hand on any of those? If so, you’re like millions of other people. No need to hide. Finances are a big issue. In fact, they are the number one reason relationships end. They are also a major cause of stress for many people.

That’s where financial literacy comes into play. If you learn about your finances, and develop the skills and confidence to manage them, you’ll enjoy less stress and greater security.

What is financial literacy?

Developing financial literacy means building the knowledge, skills, and confidence to make responsible financial decisions. Let’s break that down a bit:

What Knowledge?

- Basic banking (what is a bank account, what can I do with different accounts, debit vs. credit, etc.);

- Savings and investments (what are my savings and investment options, what savings and investments would work best for me at this stage of my life, etc.);

- Credit and debt (what is the credit trap, what credit options do I have, what do I do with debt, etc.)

- Financial fitness (what is a budget, what is gross vs. net pay, why should I track my expenses, etc.)

What Skills?

- Basic banking (how to open a bank account, how to cash a cheque, etc);

- Savings and investments (how to use a PAC to save, when to save vs. spend, when to revise my investment portfolio, etc.);

- Credit and debt (when to use credit, how to finance a home or car, how to repay debt, etc.)

- Financial fitness (how to revise my household budget, how to manage my debt, etc.)

What Confidence?

When you understand the different pieces of your financial puzzle, and have the skills and support to apply that knowledge, you’ll build confidence. You’ll feel comfortable making important financial decisions. You’ll feel supported and secure in your financial journey.

Who Benefits?

At PenFinancial Credit Union we provide services and supports to our communities. One of the ways we do this is with financial literacy workshops. We offer informative presentations to students and organizations to help Niagara residents build the economic strength, independence, and confidence they need to succeed.

In 2015 we began a special financial literacy program in partnership with Niagara Peninsula Homes (NPH) and their Team ENERGI program to support youth at risk for poverty by offering employment training and job support. Team members have most likely raised their hands on many of the Never Have I Ever financial questions.

As part of this program, PenFinancial provides seminars to help team members learn how to budget, use credit, deal with debt, and generally manage their money. In addition, they are taught about saving and four participants are given a savings boost and one-on-one coaching. The Growth IDA program is a matched savings program that encourages participants to save towards a particular goal, which will help them move from poverty to prosperity. Their savings are matched at a 3:1 ratio by PenFinancial with a minimum and maximum amount that participants can save. I had the pleasure of working with this group and I can say that the knowledge gained is something that made a huge impact on their lives.

n addition to this group, our financial literacy team has also worked with a variety of non-profit organizations, elementary schools, secondary schools and various employer groups to deliver numerous financial literacy workshops ranging from the basics to more advanced presentations on investing and credit.

From toys to houses

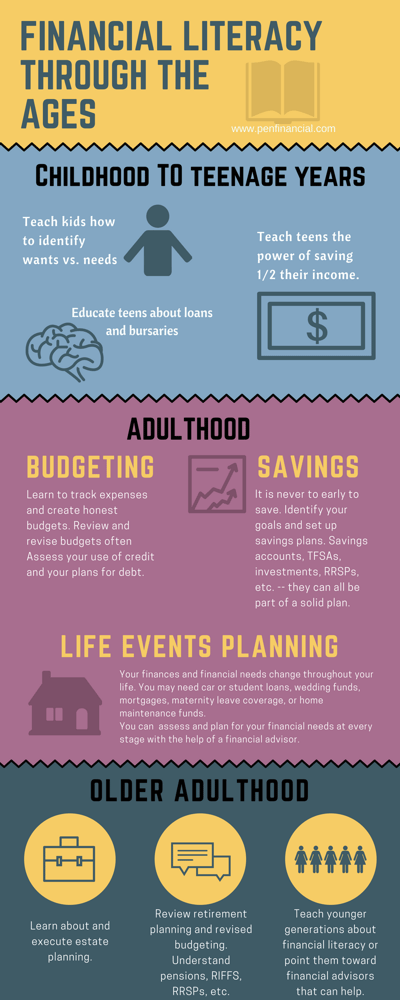

Financial literacy is important at all ages. Often we adopt our family’s habits– be they good or bad. Just as kids learn to put away their toys, they also learn how to manage money. For example, some kids learn that it's normal to get every new toy while others learn to save for big ticket items. But we can always learn something new.

You have likely experienced many of the worries from the Never Have I Ever game above – but you don’t have to. Financial literacy is one of the first steps. You can learn to better manage your money. You can feel empowered to make responsible financial decisions. Whether you want to save for retirement, pay for a car to improve employment prospects, or relieve stress by following a reasonable household budget — financial literacy can empower you to achieve your dreams. With support, you can grow your financial knowledge and skills and achieve your goals.

Don't be shy

Let us know what you wish you knew about money sooner. What did your family teach you about finances? What financial concepts or products do you want to know more about? If you work for an organization or school that could benefit from a financial literacy seminar, contact us today and we’d be happy to set something up!